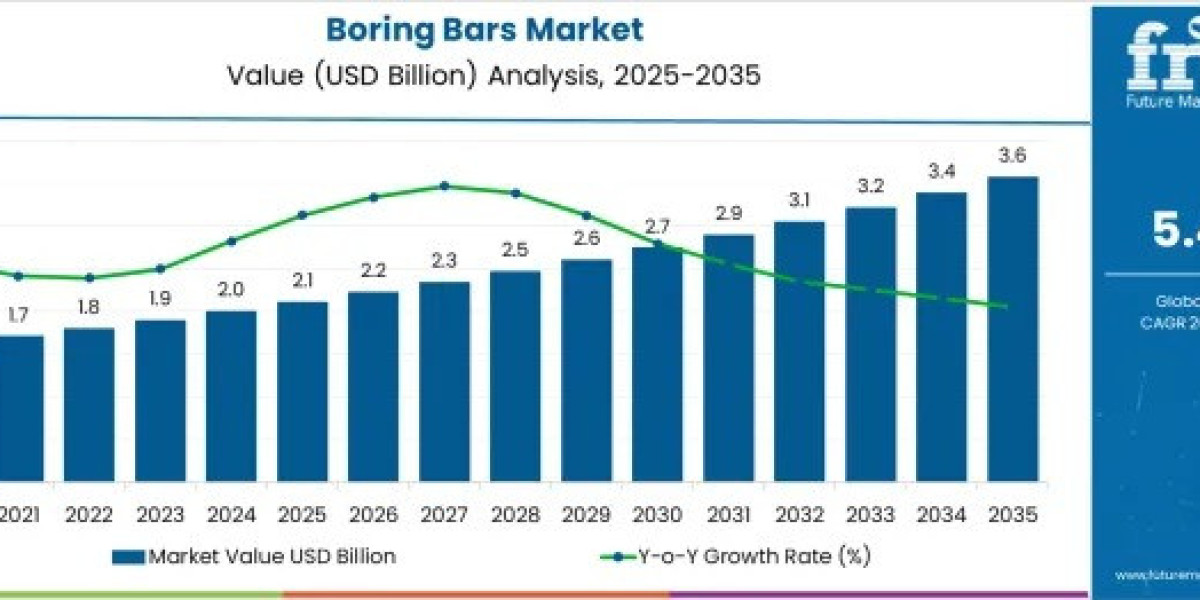

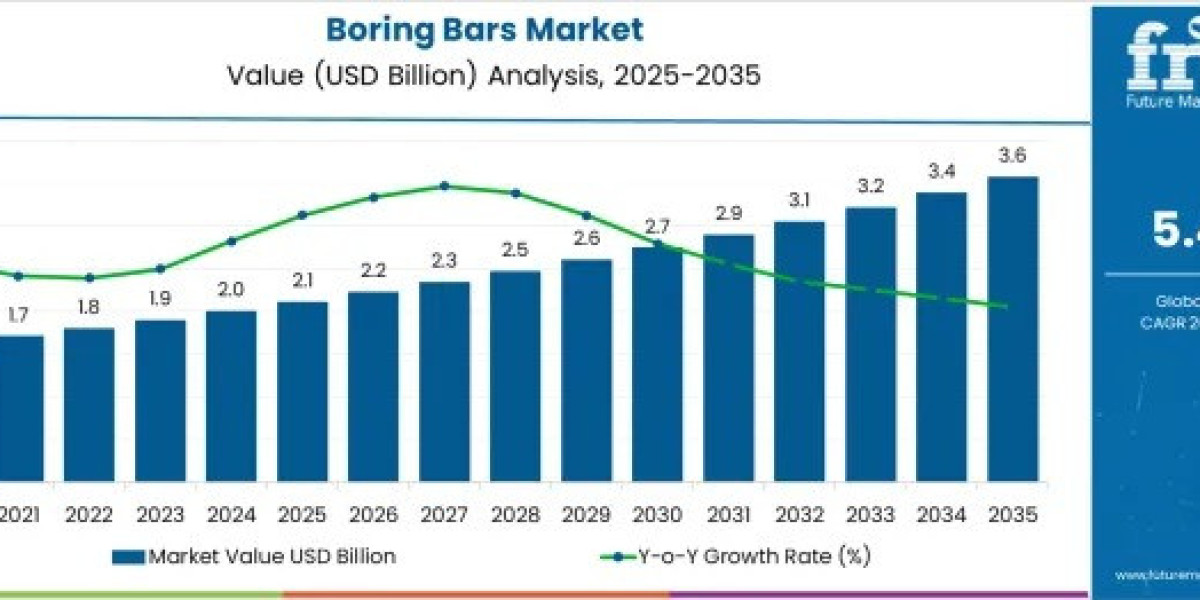

The Boring Bars Market is entering a decisive phase of growth, driven by rising demand for precision machining solutions and expanding investments in aerospace, automotive, and industrial manufacturing. The market is projected to grow from USD 2.1 billion in 2025 to USD 3.6 billion by 2035, reflecting a 5.4% CAGR. As industries push toward tighter tolerances and enhanced productivity, boring bars are becoming indispensable for high-accuracy internal machining across modern CNC and automated production environments.

Subscribe for Year-Round Insights → Stay ahead with quarterly and annual data updates

https://www.futuremarketinsights.com/reports/sample/rep-gb-23149

Steady growth in manufacturing activity, supported by automation and digital transformation, has significantly boosted adoption of advanced boring technologies. From 2020 to 2025, market demand surged due to infrastructure expansion, modernization of machining systems, and the rising use of carbide- and coating-enhanced boring tools. Between 2026 and 2030, the market is expected to expand further as manufacturers embrace modular boring bars, vibration-damping systems, and smart tooling solutions designed for consistent accuracy in high-speed operations.

By 2035, the market will benefit from sustained industrial output, widespread CNC integration, and intensified demand for precision-engineered components in aerospace, heavy equipment, and electric vehicle applications. These shifts place boring bars at the center of next-generation manufacturing strategies.

Why the Boring Bars Market Is Accelerating

The market’s upward trajectory is primarily driven by three core forces:

- Surge in Automotive & Aerospace Precision Needs

Boring bars are essential for machining engine blocks, transmission housings, turbine casings, and other components requiring micrometer-level accuracy. The rise of EV powertrains and lightweight aerospace structures is increasing the need for rigid, durable, and high-performance boring solutions. - Expansion of CNC & Automated Machining

Factories transitioning to multi-axis CNC and flexible manufacturing systems rely heavily on boring bars that deliver repeatable precision. Advanced inserts, presetting systems, and digital compatibility are helping companies reduce downtime and improve throughput. - Advancements in Tool Materials & Coatings

Carbide-based boring bars—holding 62% of the 2025 revenue share—are setting new standards in heat resistance, tool life, and performance, especially for hardened alloys and complex geometries.

Segment Insights

- Type – Standard Boring Bars Lead (56% Share in 2025)

Favored for versatility and cost effectiveness, standard boring bars remain the preferred choice for general machining across automotive, industrial, and CNC environments. - Material – Carbide Dominates (62% Share)

Carbide boring bars outperform alternatives in thermal stability and wear resistance, supporting longer tool life and fewer replacements. - Diameter – Small Diameter Bars Grow Fastest (47% Share)

Miniaturization across electronics, medical devices, and precision automotive parts is boosting demand for small-diameter boring tools.

Regional Growth Hotspots

Asia-Pacific:

China (7.3% CAGR) and India (6.8% CAGR) lead global expansion, driven by industrial automation, EV manufacturing, and rapid machining infrastructure development.

Europe:

France and the UK show rising adoption of hybrid boring systems in aerospace, energy, and defense sectors.

North America:

The U.S. growth (4.6% CAGR) is powered by aerospace, medical device manufacturing, and reshoring initiatives boosting investment in precision tooling.

Competitive Landscape

Leading industry players—Sandvik, Kennametal, Mitsubishi Materials, ISCAR (IMC Group), and Ceratizit—continue to shape the market through innovation in modular boring bars, vibration-damping technology, and digital-ready tooling. Companies are prioritizing:

- IoT-enabled boring systems

- Smart presetting capabilities

- Customizable boring solutions

- Partnerships with CNC machine manufacturers

The competitive environment increasingly favors firms that can deliver high-performance, application-specific boring systems with fast lead times and global availability.