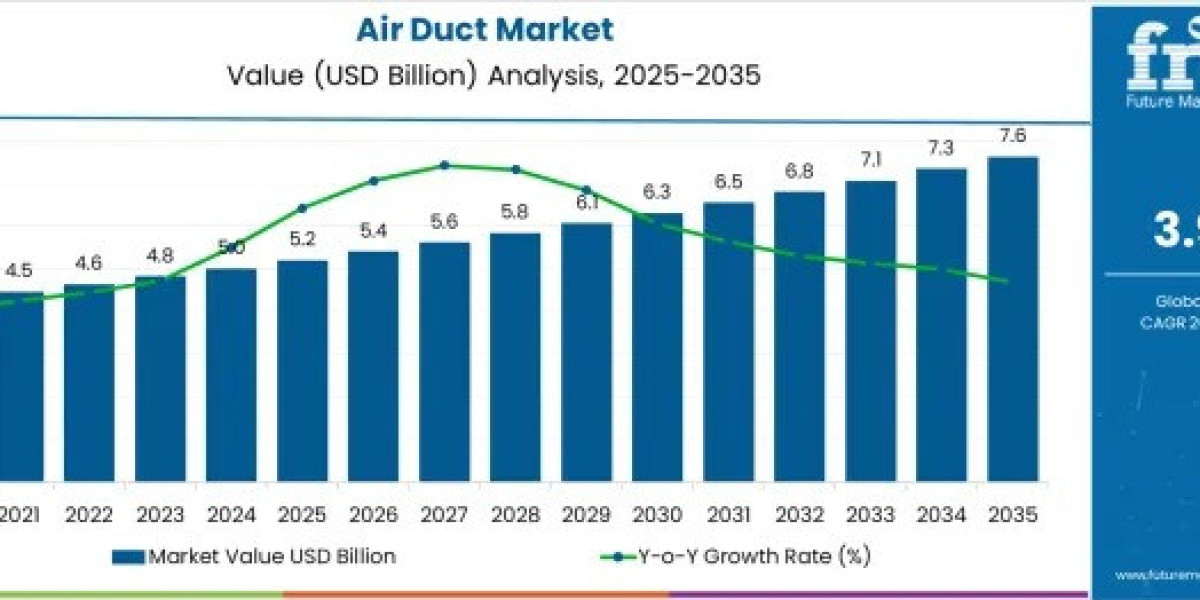

The air duct market is entering a decade of consistent expansion, driven by rising HVAC installations, stricter energy-efficiency mandates, and heightened awareness of indoor air quality across homes, offices, and industrial facilities. Valued at USD 5.2 billion in 2025, the market is projected to reach USD 7.6 billion by 2035, reflecting a CAGR of 3.9%. Although growth is moderate compared to high-velocity segments of the HVAC sector, it underscores a dependable trajectory supported by construction activity, retrofits, and the push toward sustainable building systems.

Subscribe for Year-Round Insights → Stay ahead with quarterly and annual data updates: https://www.futuremarketinsights.com/reports/sample/rep-gb-23365

From 2025 to 2030, the industry is set to add USD 1.1 billion in value, driven largely by galvanized steel and pre-insulated duct demand across commercial and institutional projects. Between 2030 and 2035, gains accelerate modestly, adding USD 1.3 billion as energy-efficient and lightweight ducting solutions gain stronger traction. Unlike markets subject to cyclical swings, the air duct industry benefits from recurring demand in commercial real estate, stringent ventilation norms, and consistent replacement cycles in aging infrastructure.

Stable Growth Supported by Regulatory Shifts and Construction Activity

The air duct market accounts for an estimated 2.7% of the global HVAC equipment industry—a reflection of its essential role in air distribution for climate control and air quality. In the broader construction ecosystem, the sector commands roughly 3.1% share due to widespread integration of ventilation systems in new builds and renovation projects.

Urban development, commercial expansion, and government-backed energy-efficiency targets have created steady momentum. The post-pandemic shift toward healthier buildings continues to drive investments in optimized duct systems designed to minimize leakage, reduce energy loss, and support clean airflow.

Segment Leadership: Galvanized Steel, Rectangular Duct Designs, and Commercial End Use

Galvanized steel remains the dominant material, projected to contribute 34% of total 2025 revenue. Its durability, corrosion resistance, and compliance with fire safety standards make it the preferred choice for large-scale HVAC networks. Rectangular ducts, estimated at 47% market share, retain their lead due to ease of installation, efficient use of space, and widespread adoption in commercial structures.

The commercial segment is expected to capture 43% of total revenues in 2025—driven by retail expansion, office developments, hospitals, educational institutions, and hospitality infrastructure. Regulations related to indoor air quality and energy performance certification are pushing facility managers to invest in standardized, high-performance ducting systems.

Technology and Innovation Fuel Market Advancements

Innovation across the U.S. HVAC sector continues to reshape air duct design and manufacturing. Pre-insulated duct panels, advanced insulation materials, and low-resistance airflow designs are enabling improved thermal efficiency and easier installation. Antimicrobial coatings and enhanced sealing systems are also becoming standard as building owners prioritize system hygiene and long-term performance.

Advancements in CAD and BIM models are helping contractors optimize duct layouts, reducing energy consumption and improving airflow distribution. IoT-integrated duct systems, capable of monitoring airflow and pressure in real time, are gaining traction in commercial facilities and smart buildings.

Regional and Country-Level Outlook

Global demand for air ducts is projected to grow at 3.9% CAGR from 2025 to 2035, with China (5.3%), India (4.9%), and Germany (4.5%) leading growth. The U.S. market is forecasted at a stable 3.3% CAGR, reflecting consistent modernization of HVAC systems and commercial real estate activity. Adoption of LEED-compliant and energy-efficient ducting solutions is expected to rise, alongside the integration of flexible, fabric, and pre-insulated duct systems.

Competitive Landscape

Leading players—including Lindab Group, Saint-Gobain, Lennox International, Novaflex Group, Thermaflex, Deflecto, M&M Manufacturing, Ruskin Titus India, and Nuaire—are strengthening their portfolios through insulated duct technologies, pre-engineered airflow systems, and expanded regional distribution networks.

Entry barriers remain relatively high due to stringent building codes, technical expertise required for precision duct fabrication, and the need for compliance across fire safety, insulation, and energy performance standards. Manufacturers are prioritizing partnerships with HVAC installers, investment in automated fabrication, and development of advanced sealing and insulation solutions to improve airflow reliability and reduce lifecycle costs.